The Facts About Medicare Part D, Frequently Asked Questions - DHCS - CA.gov Revealed

Facts About Prescription Drug Coverage (Part D) - Blue Cross Blue Shield Uncovered

You can send an exception request to your Medicare strategy by phone or in composing, and the strategy needs to respond with its choice within 72 hours or getting your request. If Related Source Here need a decision quicker due to the fact that waiting 72 hours might threaten your health, you also have a right to request an expedited request.

Where can I find the size of the Medicare Part D prescription drug plan formularies?

Contact Medicare for additional information on how to request an exception at 1-800-633-4227 (TTY users, 1-877-486-2048), 24 hr a day, 7 days a week. Medicare Part D prescription drug plans expenses, Due to the fact that Medicare prepares set their own regular monthly premiums and other out-of-pocket costs, your Medicare Part D costs might differ by plan, insurance company, and area.

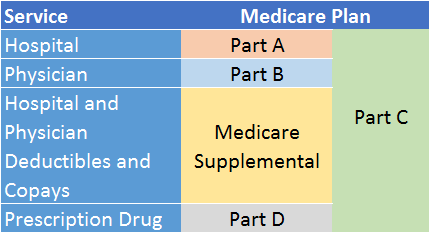

Remember that the premium for your Medicare Part D protection is separate from any monthly premiums you might owe for Medicare Part A or Part B. You'll require to keep paying your Medicare Part B premium, in addition to any regular monthly premium needed by your Medicare Prescription Drug Strategy or Medicare Benefit Prescription Drug plan.

Getting My Medicare Part D Benefits - Alzheimer's Association To Work

You may pay an additional expense if your income (as reported on your income tax return from two years ago) falls above a certain limit. Likewise understood as the Part D Income-Related Regular Monthly Modification Quantity (IRMAA), this cost is separate from the monthly premium you may spend for your Part D coverage and may change from year to year.

Medicare Part D Prescription Drug Plans - MedicareFAQ

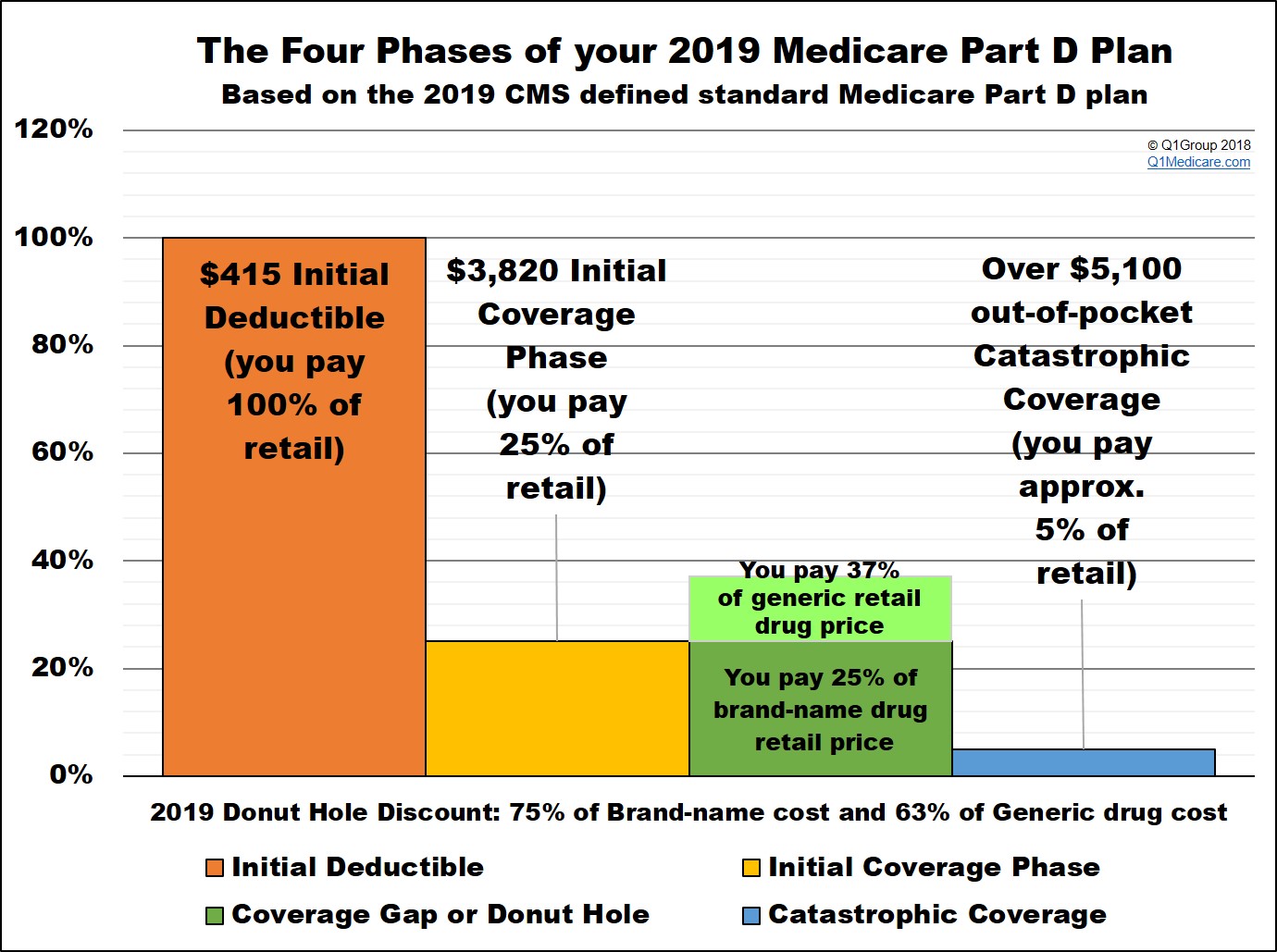

Social Security will alert you if you require to pay the Part D-IRMAA. For additional information, contact Social Security at 1-800-772-1213 (TTY users, 1-800-325-0778), Monday through Friday, from 7AM to 7PM. If you worked for a railway, call the Railroad Retirement Board for additional information at 1-877-772-5772 (TTY users, 1-312-751-4701), Monday through Friday, from 9AM to 3:30 PM.In addition to your monthly strategy premium, other Medicare Part D costs may consist of the following: Yearly deductible: This is the amount that you must pay out of pocket before your Medicare plan starts to cover costs.

Some strategies may not have a deductible. Copayments and coinsurance: You are accountable for paying these quantities for your medications after you have paid your plan deductible (if needed). A copayment is a fixed expense (for instance, a $5 copay), whereas a coinsurance is generally a portion. For instance, you may owe a 10% coinsurance for covered medications, after your strategy has actually paid its share.